(Source: The World's Endowment of Conventional Oil and its Depletion

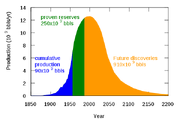

The assessment of the world's oil endowment is a sensitive subject with serious political implications and many vested interests, however, it is widely accepted that oil is a finite resource. Consequently, there are basic laws which describe the depletion of any finite resource:

- Production starts at zero;

- Production then rises to a peak which can never be surpassed;

- Once the peak has been passed, production declines until the resource is depleted.

These simple rules were first applied by Dr. M. King Hubbert in the 1950s to the world’s petroleum resources. He produced an estimate of the time from discovery to depletion called Hubbert's peak theory that suggests that for any given region, from an individual oil field to the planet as a whole, the rate of oil production tends to follow a bell-shaped curve based on the costs of extracting it and the level of market demand (right). The theory accurately predicted the peak of US oil production in the 1970s. Since then various experts have debated the application of Hubbert's theory to global oil resources together with a range of energy alternatives including coal, natural gas methane and more. While there seems to be little agreement on the exact date when global oil production will peak, the average estimate seems to hover around 2010.

Why this is important is because if the rate of world oil production begins to decline, then there will likely be less oil to meet the growing world demand thus producing an upward pressure of world oil prices.

Critics, like those at CERA, suggest that in a free market economy this situation only means that higher only prices will mean that energy sources other than conventional oil will become more viable and that there will be increased pressure to find more innovative technologies to extract remaining oil reserves. The net result will be that global energy demand will continue to be met albeit at a slightly higher price, although not debilitatingly so.

The debate is further complicated by how different companies and countries calculate their hydrocarbon reserves.Some published reserve numbers are spurious, and lax definition has led to misconceptions. For some reserves the cost in energy to extract them is more than the energy they can produce, so it makes sense to just leave them where they are. This has led to the concept ofEROEI, energy return on energy invested. As we can see in the graph to the left, not all oil is created equal. According to to geologist David Hughes some oil sources, like that extracted from oil shales (EROEI = 0.7–13.3, may not be worth the trouble.

Study of the world's oil endowment involves the elements listed in the table. Reserves are defined as Median Probability reserves in which the risks of the estimate proving above or below the actual are evenly matched. They are about 180 Gb below published reserves, which in many cases include the above-mentioned spurious numbers. The numbers refer to Conventional oil, namely that which has supplied more than 95% of all oil to date and which will continue to dominate supply until well after peak, much of it free-flowing from giant fields found long ago.

The estimate of Yet-to-Find takes into account discovery rates and the results of exploration drilling. It also recognizes that the world has now been thoroughly explored, meaning that few, if any, major new provinces await discovery. Adding 500 Gb to the Ultimate, which is itself implausible given the time and number of wells required on present trends, would delay the midpoint of depletion, which approximates to the peak, by only ten years. About half the Yet-to-Produce lies in just five Middle East countries. Their share of world production has risen from a low of 16% in 1985 to 27% in 1996, and is set to continue to rise in the absence of any new major province. The rising share will give an increasing control of the market that is expected to lead to a radical increase in oil price before the world midpoint of depletion is reached. In any event, by the end of the first decade of the 21 Century, production will have commenced its inevitable long term decline from resource constraints. Gas and non-conventional oil output will increase after peak, but it will not be a seamless transition due to the very different characteristics and depletion profiles of these hydrocarbons.

| As of 1999 | Giga-barrels |

| Produced | 820 |

| Reserves | 827 |

| Discovered | 1647 |

| Yet-to-find | 153 |

| Yet-to-produce | 980 |

| Ultimate | 1800 |

| Depletion rate | 2.2% /yr |

| Depletion midpoint | 2003 |

| Estimates Made in Prior Years |