Ottawaprofessor (talk | contribs) (Created page with 'In 2008 the price of gas in Ottawa reached $1.40 per litre (30.1¢ tax) or ~$4 USD per US gal. Within a few weeks consumers stopped buying SUV’s, pickup trucks and other gas gu…') |

No edit summary |

||

| (3 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

In 2008 the price of gas in Ottawa reached $1.40 per litre (30.1¢ tax) or ~$4 USD per US gal. Within a few weeks consumers stopped buying SUV’s, pickup trucks and other gas guzzling vehicles. They also started taking more public transit, and taking more modest vacations. Food prices jumped sharply but unlike gas prices they have been slow to return to their pre gas-spike levels -- by July 2009 they were still 5% above July 2008 levels. While the financial economic crash of 2008 provided some relief from an oil price juggernaut, already we see that today’s oil prices are trending up to the baseline levels of late 2007. |

In 2008 the price of gas in Ottawa reached $1.40 per litre (30.1¢ tax) or ~$4 USD per US gal. Within a few weeks consumers stopped buying SUV’s, pickup trucks and other gas guzzling vehicles. They also started taking more public transit, and taking more modest vacations. Food prices jumped sharply but unlike gas prices they have been slow to return to their pre gas-spike levels -- by July 2009 they were still 5% above July 2008 levels. While the financial economic crash of 2008 provided some relief from an oil price juggernaut, already we see that today’s oil prices are trending up to the baseline levels of late 2007. |

||

| + | In a recent [[Two-Dollar-A-Litre Gas in Three Years|podcast]] interview with Ottawa Citizen reporter Ken Gray,[[Thought_Leaders#Jeff_Rubin| Jeff Rubin]] |

||

| ⚫ | |||

| ⚫ | , the former Chief Economist with CIBC, suggests $2 a litre gas is near at hand, putting his best at 2012 at the outside. Rubin also points to the observation that even in the midst of the worst economic recession since the 1930s oil was trading at $70 a barrel, which even a few years ago would have been considered as extremely high in the best economic conditions. As our economy begins to recover the demand, especially in emerging economies, will drive oil to 2008 levels and beyond.[[File:Gas_-_Oil_prices_in_Canada_2004-09.png|thumb|left]] |

||

| ⚫ | What are the implications for a city like Ottawa if the peak energy predictions being made by many economists, geologists, financiers, environmentalists and community activists come to pass? Is Ottawa prepared? Are Ottawa’s community and social institutions flexible enough to adapt to so radical a change in energy prices that sees average gasoline prices, for instance, move soon to $2.50 per litre or even $4.00 or more per litre in well under a decade. The graph |

||

| ⚫ | Currently the citizens of Ottawa are debating a variety of development and transportation issues, not the least of which are the Light Rail solution and Landsdowne Live. In the case of the former, the City’s planning assumes 30% population growth most of which likely to occur on the fringes of current suburban development where cheap land and large homes will be available. Such growth patterns will require more cars, more road infrastructure and a big investment in public transit just to keep pace and avoid LA-style gridlock at rush hour periods. Will it be enough however if gas prices spike again and at higher levels than ever? The City says it can compress its 20-year development cycle for the current light rail plan if gas prices peak again but its current plan is already coming under fire for being excessive |

||

| ⚫ | What are the implications for a city like Ottawa if the peak energy predictions being made by many economists, geologists, financiers, environmentalists and community activists come to pass? Is Ottawa prepared? Are Ottawa’s community and social institutions flexible enough to adapt to so radical a change in energy prices that sees average gasoline prices, for instance, move soon to $2.50 per litre or even $4.00 or more per litre in well under a decade. The graph at the left illustrates how quickly prices for gasoline can change. Between June of 2006 and June of 2008 oil prices doubled while gasoline prices rose 40%. Even then gas prices were much slower to respond to market changes than the price of a barrel of oil. |

||

| ⚫ | In the case of the latter infrastructure issue, the Ottawa Sports and Entertainment Group (OSEG) team is being slagged for not providing enough parking and for potentially clogging the streets of the Glebe. Both the team and the City have assumed a “build it and they will come” scenario. But if the price of football admission or an afternoon’s shopping also includes another $40-50 for a ¼ tank of gas, will residents still be as interested in making the trip? Will the project still fly if it must rely on Glebe residents to sustain it? Probably not. |

||

| ⚫ | Currently the citizens of Ottawa are debating a variety of development and transportation issues, not the least of which are the [http://ottawa.ca/residents/public_consult/transit_tunnel/cost_affordability/background_en.html Light Rail ]solution and [http://city.ottawa.on.ca/residents/public_consult/lansdowne_partnership/index_en.html Landsdowne Live]. In the case of the former, the City’s planning assumes 30% population growth most of which likely to occur on the fringes of current suburban development where cheap land and large homes will be available. Such growth patterns will require more cars, more road infrastructure and a big investment in public transit just to keep pace and avoid LA-style gridlock at rush hour periods. Will it be enough however if gas prices spike again and at higher levels than ever? The City says it can compress its 20-year development cycle for the current light rail plan if gas prices peak again but its current plan is already coming under fire from Ontario Premier and Ottawa MP Dalton McGuinty for being excessive at a cost of $6.6 billion. Compressing timelines will only add to the cost and will this even be possible when other cities are clamouring for similar federal and provincial handouts? Given its track record, is the City capable of such commitment and focus or are they just dreaming in technocolour? |

||

| ⚫ | Such questions and many more are important to consider as we move from an era of cheap carbon-based energy to a period of high and higher carbon-based energy. The prestigious International Energy Agency (IEA) now estimates that production in the world’s existing oil wells (producing 84 million barrels per day) are declining at an average rate of 6.7% a year which when projected over the next 20 years means that existing wells will produce only 21 million barrels per day. |

||

| + | |||

| ⚫ | In the case of the latter infrastructure issue, the Ottawa Sports and Entertainment Group (OSEG) team is being slagged for not providing enough parking and for potentially clogging the streets of the Glebe. Both the team and the City have assumed a “build it and they will come” scenario. But if the price of football admission or an afternoon’s shopping also includes another $40-50 for a ¼ tank of gas, will residents still be as interested in making the trip? Will the project still fly if it must rely on Glebe residents to sustain it? Probably not. |

||

| + | |||

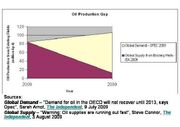

| ⚫ | Such questions and many more are important to consider as we move from an era of cheap carbon-based energy to a period of high and higher carbon-based energy. The prestigious International Energy Agency (IEA) now estimates that production in the world’s existing oil wells (producing 84 million barrels per day) are declining at an average rate of 6.7% a year which when projected over the next 20 years means that existing wells will produce only 21 million barrels per day.[[File:Oil_Production_Gap.jpg|thumb]] |

||

The short fall is estimated by the IEA to be equivalent to four Saudi Arabia’s worth of oil. If the growing demand for oil from emerging countries like China and India is counted that shortfall increases to six Saudi Arabia’s worth of oil. The likelihood that oil producers have overlooked that much oil on the planet is about zero. The likelihood of technology and alternative energy sources replacing that much oil is also zero. So the price of oil and everything either derived or depending on oil will go up, dramatically relentlessly and soon. How will Ottawa cope? |

The short fall is estimated by the IEA to be equivalent to four Saudi Arabia’s worth of oil. If the growing demand for oil from emerging countries like China and India is counted that shortfall increases to six Saudi Arabia’s worth of oil. The likelihood that oil producers have overlooked that much oil on the planet is about zero. The likelihood of technology and alternative energy sources replacing that much oil is also zero. So the price of oil and everything either derived or depending on oil will go up, dramatically relentlessly and soon. How will Ottawa cope? |

||

| Line 14: | Line 17: | ||

While it was clear that even short term prices of $1.40 per litre of gasoline began to have serious repercussions, not the least of which was a major global recession, sustained prices at that level or higher will begin to radically alter our economy and way of life. Here’s my timeline projection of four possible scenarios. |

While it was clear that even short term prices of $1.40 per litre of gasoline began to have serious repercussions, not the least of which was a major global recession, sustained prices at that level or higher will begin to radically alter our economy and way of life. Here’s my timeline projection of four possible scenarios. |

||

| + | {|cellspacing="1" cellpadding="1" border="1" align="center" width="500" |

||

| ⚫ | To begin a conversation with this timeline in mind let’s consider eight areas of great importance to each of us -- Food, Incomes, Transportation, Housing, Economic, Health, Public Services, and Environment. In each of these areas we will be forced to make different choices to accommodate rising prices of energy. Some of the choices we will have to make will be difficult, even hard. But in the end the results will not always be unpleasant. Some like the impact on our health and our sense of community will be downright positive. But there will be pain from the adjustment, something we may be able to lessen if we can be proactive today and begin changing our habits and behaviours before being forced to do so by the high price of energy. |

||

| + | !align="center" valign="middle" scope="col"|Scenario |

||

| + | !align="center" valign="middle" scope="col"|Gas price |

||

| + | !align="center" valign="middle" scope="col"|Time Projection |

||

| + | |- |

||

| + | |align="center" valign="middle"|'''Baseline ''' |

||

| + | !align="center" valign="middle"|'''$2.40 / '''''' gal ~ $0.88 ''' '''/ litre CDN''' |

||

| + | !align="center" valign="middle"| |

||

| + | |- |

||

| + | |align="center" valign="middle"|'''A''' |

||

| + | !align="center" valign="middle"|'''$4 / '''''' gal ~ $1.40 / litre''' |

||

| + | !align="center" valign="middle"|'''first set June 2008 but likely ''' '''again by Summer 2010''' |

||

| + | |- |

||

| + | |align="center" valign="middle"|'''B''' |

||

| + | !align="center" valign="middle"|'''$6 / '''''' gal ~ $2 / litre''' |

||

| + | !align="center" valign="middle"|'''June 2011''' |

||

| + | |- |

||

| + | |align="center" valign="middle"|'''C''' |

||

| + | !align="center" valign="middle"|'''$8 / '''''' gal ~ $2.50 / litre''' |

||

| + | !align="center" valign="middle"|'''June 2013''' |

||

| + | |- |

||

| + | |align="center" valign="middle"|'''D''' |

||

| + | !align="center" valign="middle"|'''$12 / '''''' gal ~ $4.00 / litre''' |

||

| + | !align="center" valign="middle"|'''June 2015''' |

||

| + | |} |

||

| + | |||

| ⚫ | To begin a conversation with this timeline in mind, let’s consider eight areas of great importance to each of us -- Food, Incomes, Transportation, Housing, Economic, Health, Public Services, and Environment. In each of these areas we will be forced to make different choices to accommodate rising prices of energy. Some of the choices we will have to make will be difficult, even hard. But in the end the results will not always be unpleasant. Some like the impact on our health and our sense of community will be downright positive. But there will be pain from the adjustment, something we may be able to lessen if we can be proactive today and begin changing our habits and behaviours before being forced to do so by the high price of energy. |

||

Latest revision as of 20:06, 4 November 2009

In 2008 the price of gas in Ottawa reached $1.40 per litre (30.1¢ tax) or ~$4 USD per US gal. Within a few weeks consumers stopped buying SUV’s, pickup trucks and other gas guzzling vehicles. They also started taking more public transit, and taking more modest vacations. Food prices jumped sharply but unlike gas prices they have been slow to return to their pre gas-spike levels -- by July 2009 they were still 5% above July 2008 levels. While the financial economic crash of 2008 provided some relief from an oil price juggernaut, already we see that today’s oil prices are trending up to the baseline levels of late 2007.

In a recent podcast interview with Ottawa Citizen reporter Ken Gray, Jeff Rubin

, the former Chief Economist with CIBC, suggests $2 a litre gas is near at hand, putting his best at 2012 at the outside. Rubin also points to the observation that even in the midst of the worst economic recession since the 1930s oil was trading at $70 a barrel, which even a few years ago would have been considered as extremely high in the best economic conditions. As our economy begins to recover the demand, especially in emerging economies, will drive oil to 2008 levels and beyond.

What are the implications for a city like Ottawa if the peak energy predictions being made by many economists, geologists, financiers, environmentalists and community activists come to pass? Is Ottawa prepared? Are Ottawa’s community and social institutions flexible enough to adapt to so radical a change in energy prices that sees average gasoline prices, for instance, move soon to $2.50 per litre or even $4.00 or more per litre in well under a decade. The graph at the left illustrates how quickly prices for gasoline can change. Between June of 2006 and June of 2008 oil prices doubled while gasoline prices rose 40%. Even then gas prices were much slower to respond to market changes than the price of a barrel of oil.

Currently the citizens of Ottawa are debating a variety of development and transportation issues, not the least of which are the Light Rail solution and Landsdowne Live. In the case of the former, the City’s planning assumes 30% population growth most of which likely to occur on the fringes of current suburban development where cheap land and large homes will be available. Such growth patterns will require more cars, more road infrastructure and a big investment in public transit just to keep pace and avoid LA-style gridlock at rush hour periods. Will it be enough however if gas prices spike again and at higher levels than ever? The City says it can compress its 20-year development cycle for the current light rail plan if gas prices peak again but its current plan is already coming under fire from Ontario Premier and Ottawa MP Dalton McGuinty for being excessive at a cost of $6.6 billion. Compressing timelines will only add to the cost and will this even be possible when other cities are clamouring for similar federal and provincial handouts? Given its track record, is the City capable of such commitment and focus or are they just dreaming in technocolour?

In the case of the latter infrastructure issue, the Ottawa Sports and Entertainment Group (OSEG) team is being slagged for not providing enough parking and for potentially clogging the streets of the Glebe. Both the team and the City have assumed a “build it and they will come” scenario. But if the price of football admission or an afternoon’s shopping also includes another $40-50 for a ¼ tank of gas, will residents still be as interested in making the trip? Will the project still fly if it must rely on Glebe residents to sustain it? Probably not.

Such questions and many more are important to consider as we move from an era of cheap carbon-based energy to a period of high and higher carbon-based energy. The prestigious International Energy Agency (IEA) now estimates that production in the world’s existing oil wells (producing 84 million barrels per day) are declining at an average rate of 6.7% a year which when projected over the next 20 years means that existing wells will produce only 21 million barrels per day.

The short fall is estimated by the IEA to be equivalent to four Saudi Arabia’s worth of oil. If the growing demand for oil from emerging countries like China and India is counted that shortfall increases to six Saudi Arabia’s worth of oil. The likelihood that oil producers have overlooked that much oil on the planet is about zero. The likelihood of technology and alternative energy sources replacing that much oil is also zero. So the price of oil and everything either derived or depending on oil will go up, dramatically relentlessly and soon. How will Ottawa cope?

While it was clear that even short term prices of $1.40 per litre of gasoline began to have serious repercussions, not the least of which was a major global recession, sustained prices at that level or higher will begin to radically alter our economy and way of life. Here’s my timeline projection of four possible scenarios.

| Scenario | Gas price | Time Projection |

|---|---|---|

| Baseline | '$2.40 / ' gal ~ $0.88 / litre CDN | |

| A | '$4 / ' gal ~ $1.40 / litre | first set June 2008 but likely again by Summer 2010 |

| B | '$6 / ' gal ~ $2 / litre | June 2011 |

| C | '$8 / ' gal ~ $2.50 / litre | June 2013 |

| D | '$12 / ' gal ~ $4.00 / litre | June 2015 |

To begin a conversation with this timeline in mind, let’s consider eight areas of great importance to each of us -- Food, Incomes, Transportation, Housing, Economic, Health, Public Services, and Environment. In each of these areas we will be forced to make different choices to accommodate rising prices of energy. Some of the choices we will have to make will be difficult, even hard. But in the end the results will not always be unpleasant. Some like the impact on our health and our sense of community will be downright positive. But there will be pain from the adjustment, something we may be able to lessen if we can be proactive today and begin changing our habits and behaviours before being forced to do so by the high price of energy.